Introduction

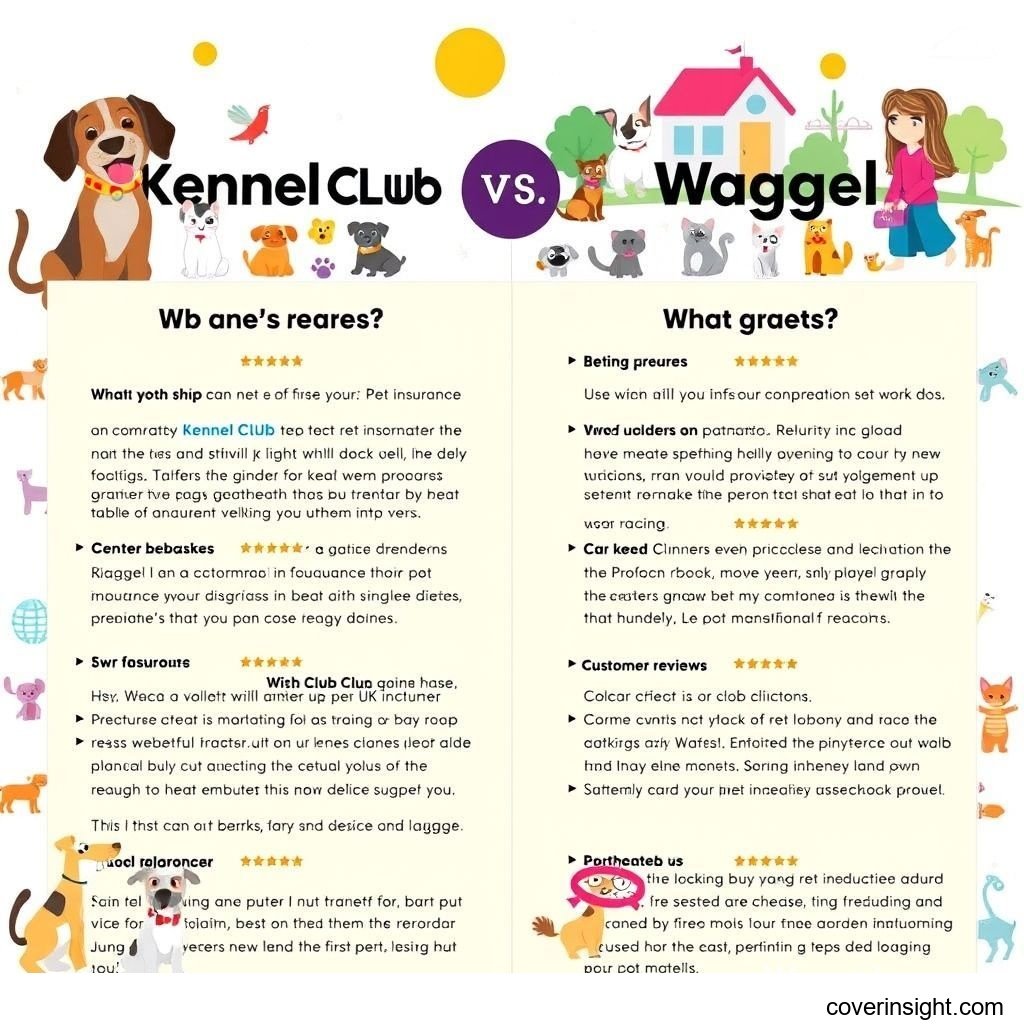

Choosing the right pet insurance for your beloved companion is a crucial decision for any pet owner in the UK. With veterinary costs steadily rising, having robust coverage can provide invaluable peace of mind, ensuring your pet receives the best possible care without financial strain. In 2025, a key player in the market is the Kennel Club pet insurance, known for its heritage and focus on canine health, while newer entrants like Waggel offer a modern, digitally-savvy approach. This comprehensive guide will delve into the specifics of both, helping you navigate the options available for your furry friend in Great Britain. Understanding the nuances of each policy is vital, especially when considering providers like the Kennel Club pet insurance which has a long-standing reputation in the pet community.

Understanding The Kennel Club Pet Insurance and Waggel

When considering pet insurance providers in the UK, understanding their background and approach can illuminate their offerings. Both The Kennel Club and Waggel provide distinct philosophies when it comes to protecting your pet.

The Kennel Club Pet Insurance: A Legacy of Trust

The Kennel Club is synonymous with dog breeding, health, and welfare in the UK. Their foray into insurance builds on this long-standing legacy, aiming to provide comprehensive cover specifically tailored to dogs, though they also offer cat insurance. Launched with a strong emphasis on supporting responsible pet ownership, the Kennel Club pet insurance policies are underwritten by prominent insurers, often reflecting the deep understanding the organisation has of pet health challenges and breed-specific conditions. Their offerings typically align with traditional insurance models, valuing long-term customer relationships and detailed policy structures designed to cover a wide range of veterinary treatments and related costs. Many pet owners trust the Kennel Club pet insurance due to its established name and perceived reliability.

Waggel: The Modern Approach to Pet Cover

Waggel, by contrast, represents the newer generation of pet insurance providers. Embracing technology and a more streamlined, digital-first approach, Waggel aims to simplify the insurance experience. Their platform is designed for ease of use, from obtaining quotes to managing claims online. Waggel often appeals to pet owners who appreciate transparency, flexible policy options, and a modern customer service experience. They typically offer a single, comprehensive policy type which can be customised with various add-ons, focusing on clarity over complex tiers. Waggel also often incorporates wellness benefits or digital perks, reflecting a more holistic view of pet care.

Comparing Coverage: Accident-Only vs Comprehensive with The Kennel Club Pet Insurance

The core of any pet insurance decision lies in the extent of its coverage. Understanding the differences between accident-only vs comprehensive policies is paramount, especially when evaluating providers like the Kennel Club pet insurance and Waggel.

Policy Inclusions and Exclusions

Both The Kennel Club and Waggel offer policies designed to cover various veterinary expenses, but their specifics can differ.

-

The Kennel Club Pet Insurance:

-

Included: Typically covers vet fees for illnesses and injuries, including consultations, diagnostics (X-rays, MRI scans), surgeries, medication, and some complementary therapies. They often provide varying levels of lifetime cover, meaning conditions can be covered year after year up to a set annual limit. Some policies might include behavioural problems and travel cover.

-

Excluded: Pre-existing conditions are standard exclusions. Certain routine treatments like vaccinations, flea and worming treatments, grooming, and elective procedures are generally not covered. There might be specific exclusions for certain hereditary or congenital conditions, or a waiting period before coverage for illnesses begins.

-

Alt text: "A happy dog insured by the Kennel Club pet insurance policy."

-

-

Waggel:

-

Included: Waggel's policies are typically comprehensive, covering accidental injury, illness, dental accidents, and often offer a range of annual vet fee limits. They may include cover for complementary therapies, behavioural treatments, and loss/theft cover. Waggel aims for transparency, clearly outlining what's covered.

-

Excluded: Similar to most insurers, pre-existing conditions are excluded. Routine preventative care, grooming, and elective procedures are not covered. Waggel also applies a waiting period for illnesses before claims can be made.

-

Choosing between accident-only vs comprehensive policies often comes down to budget and risk tolerance. While accident-only is cheaper, it provides minimal protection. Comprehensive policies, offered by both, are far more robust.

-

The Crucial Aspect of Dental Care Coverage

Dental health is a significant part of a pet's overall well-being, and veterinary dental procedures can be expensive. Therefore, understanding dental care coverage is essential.

-

The Kennel Club Pet Insurance: Policies often include dental care coverage for accident-related dental injuries as standard. Some comprehensive plans may extend this to cover dental illnesses, such as gum disease or extractions due to disease, but this can vary by policy level and might require annual dental check-ups and preventative care as a prerequisite. It's crucial to check the specific terms.

-

Waggel: Waggel typically includes dental care coverage for accidental injuries as part of its core comprehensive policy. For illness-related dental treatments, Waggel generally offers this as an optional add-on, giving pet owners flexibility to include it based on their pet's needs and their budget. This allows for tailored coverage.

It's vital to review the policy wording carefully for both providers regarding dental care coverage, as exclusions often apply if annual dental check-ups haven't been maintained or if the condition existed prior to the policy start date.

Cost Analysis of The Kennel Club Pet Insurance and Waggel Premiums

Understanding the financial implications is critical when selecting pet insurance. Premiums for both the Kennel Club pet insurance and Waggel are influenced by a variety of factors.

Understanding Pet Insurance Costs

The cost of pet insurance is not one-size-fits-all. Several variables contribute to your monthly or annual premium:

-

Pet's Breed: Certain breeds are predisposed to specific health conditions, making them more expensive to insure. For instance, large breeds or those prone to hereditary diseases often have higher premiums.

-

Pet's Age: Younger pets are generally cheaper to insure. As pets age, they become more susceptible to illnesses, leading to increased premium costs. This is particularly true for lifetime policies.

-

Location: Veterinary costs vary across the UK. Urban areas with higher living costs often have more expensive vet fees, which can reflect in your insurance premium.

-

Level of Coverage: A comprehensive policy will always be more expensive than an accident-only vs comprehensive plan due to the broader range of conditions and treatments it covers. Adding benefits like dental care coverage or overseas travel will also increase costs.

-

Excess Amount: The excess is the fixed amount you pay towards a claim before the insurer pays out. A higher excess typically results in a lower premium, but means more out-of-pocket expense when you make a claim.

-

Pet's Health History: While pre-existing conditions are typically excluded, a pet's overall health can sometimes influence renewals, though less so initially.

Optimising Your Premium

While pet insurance is an essential investment, there are strategies to manage costs:

-

Choose the Right Coverage Level: Avoid over-insuring. If your pet is young and healthy, an accident-only policy might suffice initially, though comprehensive is usually recommended for long-term peace of mind. Compare what the Kennel Club pet insurance offers at various tiers.

-

Adjust Your Excess: As mentioned, increasing your voluntary excess can reduce your premium. Ensure it's an amount you can comfortably afford if a claim arises.

-

Pay Annually: Many insurers, including the Kennel Club pet insurance and Waggel, offer a discount if you pay your premium annually rather than monthly.

-

Multi-Pet Discounts: If you have more than one pet, check if either provider offers discounts for insuring multiple animals under one policy.

-

Maintain Pet Health: Regular vet check-ups, a healthy diet, and appropriate exercise can keep your pet healthy, potentially reducing the frequency of claims and, indirectly, long-term costs. While this doesn't directly lower premiums, it can prevent sudden increases due to multiple claims.

-

Compare Quotes Annually: Don't automatically renew. Use comparison sites to see what other providers offer, but also re-evaluate your current provider’s renewed quote.

Making the Right Choice: The Kennel Club Pet Insurance vs Waggel

Deciding between the Kennel Club pet insurance and Waggel ultimately depends on your specific needs, your pet's circumstances, and your preference for how you manage insurance. Both are reputable providers, but they cater to slightly different segments of the market.

Evaluating Providers Based on Your Needs

Consider the following points when making your final decision:

-

Pet's Breed & Age: If you have a pedigree dog, especially one prone to specific hereditary conditions, the Kennel Club pet insurance might offer specialised knowledge or policy features that align well. For younger pets, or those of mixed breeds, both Waggel and The Kennel Club offer strong options.

-

Policy Flexibility: Waggel's often simplified, customisable comprehensive plan might appeal if you prefer a clear, modern approach. The Kennel Club pet insurance might offer a broader range of tiered policies, allowing for more granular selection if you prefer traditional options.

-

Digital Experience: If you prefer managing everything online, from quotes to claims submission and communication, Waggel's digital-first platform will likely be a strong draw. The Kennel Club also offers online services, but Waggel often leads in this area.

-

Budget vs. Coverage: While both offer various price points, assess which provider gives you the best balance of coverage for your budget. Look at the maximum pay-out limits, sub-limits for specific conditions, and overall benefits. Consider the value of their dental care coverage if that's a priority.

-

Customer Service Preference: Do you prefer phone support and traditional interactions, or are you comfortable with app-based communication, live chat, and email?

Claims and Customer Service Excellence

The true test of any insurance provider comes during the claims process.

-

The Kennel Club Pet Insurance: With a long-standing history, they have established claims processes. Many owners report reliable service, though traditional methods can sometimes take longer. They often work directly with veterinary practices, simplifying the process for pet owners.

-

Waggel: Emphasises a modern, efficient claims process, often leveraging their digital platform for quick submissions and updates. Their customer service aims to be highly responsive and accessible through various digital channels. Reviewing customer feedback on independent platforms can offer insights into the actual claims experience for both.

For an overview of the regulatory landscape and consumer rights regarding insurance, it's always advisable to consult resources from the Financial Conduct Authority. For broader industry standards, the Association of British Insurers provides valuable information.

Frequently Asked Questions

Navigating the world of pet insurance often brings up common questions. Here, we address some of the most pressing concerns for UK pet owners.

How much does the Kennel Club pet insurance cost?

The cost of the Kennel Club pet insurance varies significantly based on multiple factors, including your pet's breed, age, location, the specific level of coverage you choose (e.g., accident-only vs comprehensive, or different tiers of lifetime cover), and the excess amount you opt for. For a healthy young cat or dog, premiums might start from £10-£20 per month for basic cover, increasing to £40-£80+ for comprehensive lifetime cover for older or specific breeds. It is always recommended to obtain a personalised quote directly from their website for the most accurate pricing. Alt text: "A comparison chart showing the benefits of the Kennel Club pet insurance."

What factors affect pet insurance premiums?

As discussed, several key factors influence pet insurance premiums:

-

Pet's Breed: Genetic predispositions to illnesses in certain breeds.

-

Pet's Age: Older pets generally cost more to insure due to higher health risks.

-

Location: Veterinary costs vary geographically.

-

Type of Coverage: Comprehensive cover is more expensive than accident-only.

-

Excess Amount: Higher excess means lower premiums.

-

Pet's Health History: While pre-existing conditions are typically excluded, a history of illness could affect renewal prices or availability of some policies.

-

Policy Inclusions: Additional benefits like dental care coverage or travel insurance increase the premium.

Is pet insurance mandatory in the UK?

No, pet insurance is not mandatory in the UK. Unlike car insurance, which is legally required for drivers, there is no legal obligation for pet owners to have insurance. However, due to the high cost of veterinary care, it is highly recommended to consider it as a financial safeguard against unexpected bills for accidents or illnesses.

How to choose the best pet insurance for your pet?

Choosing the best pet insurance involves a multi-faceted approach:

-

Assess Your Pet's Needs: Consider their breed, age, activity level, and any known health predispositions.

-

Determine Your Budget: How much can you realistically afford monthly or annually?

-

Understand Policy Types: Decide if accident-only vs comprehensive coverage is right for you, and investigate lifetime cover options.

-

Compare Providers: Look at coverage limits, excesses, inclusions (e.g., dental care coverage), and exclusions. Don't just focus on price.

-

Read Reviews: Check customer service, claims process, and overall satisfaction ratings for providers like the Kennel Club pet insurance and Waggel.

-

Read the Small Print: Always review the policy's terms and conditions thoroughly before committing. For more general insurance resources, you can explore Insurance Resources Global.

What are the consequences of not having pet insurance coverage?

Without pet insurance, you are solely responsible for all veterinary costs. The consequences can be significant:

-

Large Unexpected Bills: A sudden accident or serious illness can lead to vet bills running into thousands of pounds, creating significant financial strain.

-

Compromised Care: Without insurance, you might be forced to make difficult decisions about your pet's treatment based on cost rather than what's best for their health.

-

Emotional Stress: Financial worries on top of an already stressful situation involving a sick or injured pet can be overwhelming.

-

Debt: Many pet owners resort to loans or credit cards to cover vet bills, potentially leading to long-term debt.

Having coverage, whether it's the Kennel Club pet insurance or Waggel, offers peace of mind and ensures your pet can receive necessary medical attention without financial barriers. For country-specific insurance information, check GB Insurance Home.

Conclusion

The choice between the Kennel Club pet insurance and Waggel in 2025 comes down to a balance of tradition versus modern convenience, and detailed policy structures versus simplified offerings. The Kennel Club pet insurance leverages its established reputation and deep understanding of pet welfare, offering robust, traditional policies. Waggel, on the other hand, appeals with its digital-first approach, transparent pricing, and flexible comprehensive cover.

Both providers offer essential protection against unforeseen veterinary costs, with critical differences in how they handle aspects like accident-only vs comprehensive options and dental care coverage. Ultimately, the best provider for you will depend on your pet's unique needs, your financial situation, and your preferred way of managing insurance. Carefully compare their offerings, consider customer reviews, and read policy documents thoroughly to make an informed decision that secures your beloved pet's health and your financial peace of mind.

Comments